If you're trying to plan out your college expenses, the ability to estimate your federal aid eligibility can be a big advantage. There are so many factors to take into account, though—it might be hard to know where to begin.

The good news is that calculating your Pell Grant eligibility probably isn't as hard as you think it is. And there's an added bonus: calculating Pell Grant eligibility will also generate information about other federal aid programs, like Stafford loans and work study. Best of all, it should only take about 10 minutes! Read on to learn about what you need to get started and how to calculate your eligibility.

What Information Do You Need Before You Get Started?

There are certain pieces of information that you probably don't need to research—like how many siblings you have, or your marital status—that affect Pell Grant calculations. The calculator will also check for certain federal aid eligibility requirements. If you don't meet all federal requirements, you can't receive the Pell Grant; check out our Pell Grant eligibility guide for more information before you get started.

The information you probably will need to research will be on your family's finances. If you don't have the documentation on hand it's fine to give estimates, but your calculations probably won't be as accurate. Here's the documentation you should have when you do your calculations:

- Your parents' most recent tax returns. Specifically, you need their adjusted gross income. The calculator will tell you exactly what line number you can find the adjusted gross income, depending on what form you have available.

- Your parents' asset net worth. The calculator will estimate an asset net worth based on the adjusted gross income you enter, but you may need to edit this. Asset net worth is defined as what your parents own (money, businesses, investments) minus any debt on those assets. You shouldn't include your parents' home or retirement plans.

- Your own most recent tax returns and asset net worth. If you don't file taxes or have any assets (like cash savings), you don't have to worry about inputting this information.

Once you've gathered all this information, all you need to do is plug it into the federal aid calculator!

What was that thing Ben Franklin said about taxes again?

How Do I Actually Estimate My Pell Grant Award?

If you have financial information discussed above, this next step should be quick and easy.

First, you should know there's no dedicated application for the Pell Grant—instead, all applicants are considered for it when they submit their Free Application for Federal Student Aid, or FAFSA. To calculate your Pell award, we'll be using the FAFSA aid calculator called ... wait for it ... the FAFSA4caster. The FAFSA4caster isn't the actual application, so using it doesn't mean you've submitted an application for the Pell Grant. Although the calculator is pretty accurate, there's no guarantee that you'll receive the exact amount of aid estimated by the 4caster.

To get started, select the FAFSA4caster link towards the top of this page. From there, follow the prompts on the screen; answer all questions as honestly as possible for an accurate estimate. There's a "helps and hints" section on the right side of the screen that will provide more information about the question prompts.

Interpreting Your Calculator Results

I completed an example calculation to demonstrate how to interpret your federal aid eligibility results. Keep in mind that my (fake!) results will likely look different from yours.

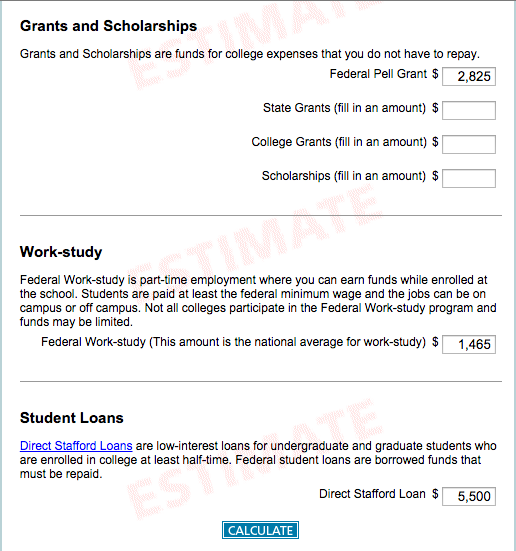

Here's an example of what an aid eligibility calculation looks like before you enter college cost

When making this example, I chose all of the standard options (no special housing circumstances, married/remarried parents, US citizen), didn't enter any personal income, and set my "parents'" income to $50,000. Based on this information, I would be eligible for a $2885 Pell Grant, in addition to $1465 in work-study and $5,500 in Stafford Loans. You can see these results in the image above.

You've probably noticed that there are some blank boxes for state grants, college grants, and scholarships. The FAFSA4caster doesn't calculate these for you—it's just for federal aid—but it includes these boxes in case you have other sources of aid you wanted to take into account.

What you can do next, if you'd like, is calculate the difference between the total cost of college and the amount of aid you get. The difference would be the remaining balance, or what you would be responsible for paying. Using the same information as above, I entered a College Cost of $30,000 and pressed "calculate."

An example estimate of college cost minus total aid available

In this example, my total aid (Pell Grant + work study + Stafford Loan) subtracted from my College Cost ($30,000) leaves me with a difference of $20,210. You'll notice that at the bottom of your calculation page there are spots to input savings and additional loan amounts—these numbers can be helpful to play around with if you're working out how to pay that remaining balance.

What if the Aid You're Eligible For Isn't Enough?

You've figured out roughly what you'll have to pay for college after accounting for federal aid, but what if that "difference" calculation is more than you expected? The good news is that you have other opportunities for aid.

State financial aid also uses information generated by the FAFSA, so make sure to submit your application sooner rather than later.

You can also look into private loans, scholarships through your school, or other merit-based scholarships.